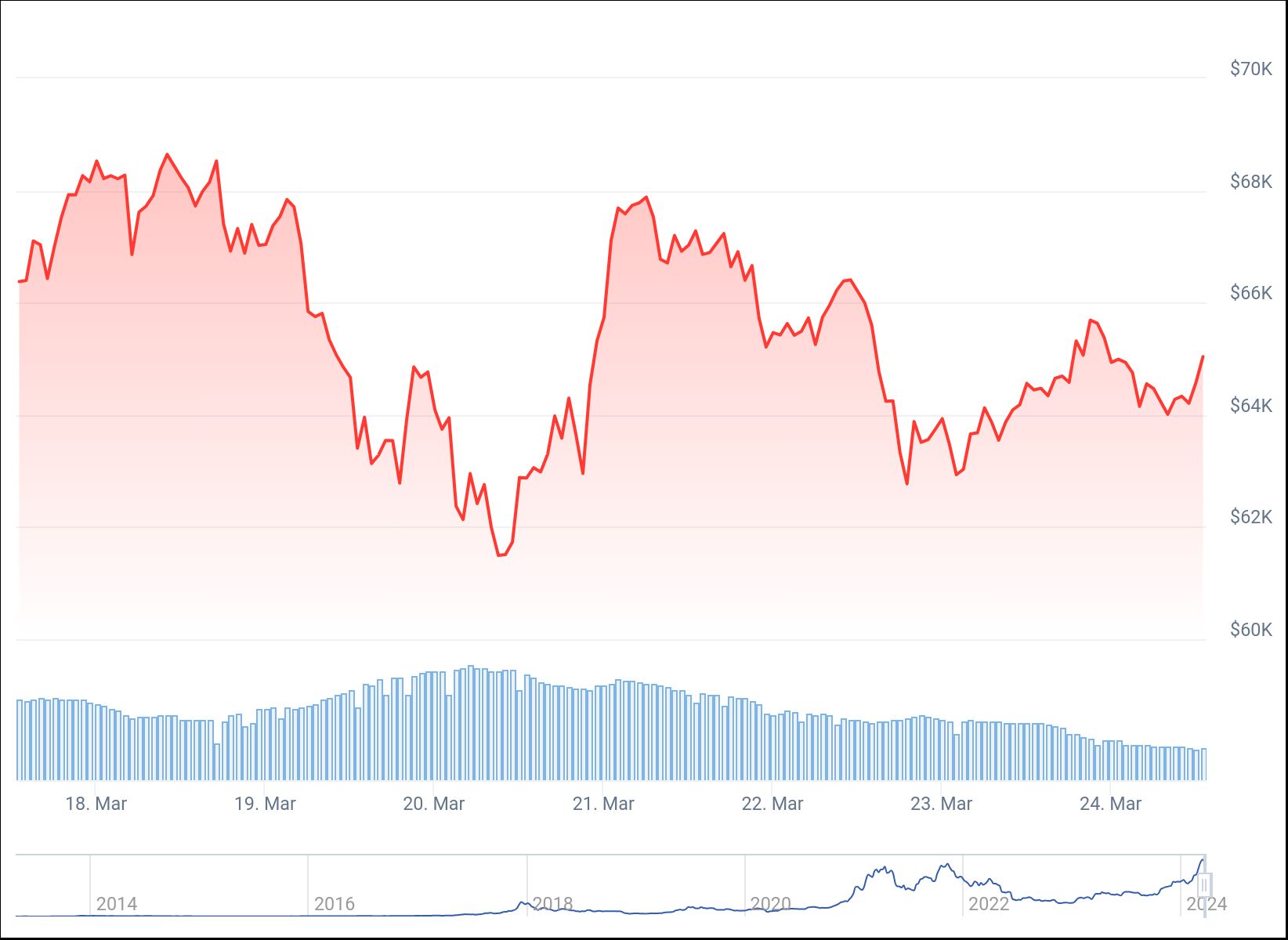

Bitcoin correction

As the halving approaches, Bitcoin is holding above the $63,000 mark, showing persistence in the fight, and prices are predicted to undergo an even more significant correction in the near future. Over the past week, the price of BTC has fallen by 2.6%, and in the last two weeks by 4%.

Bitcoin halving is an automatic process in which the reward for miners is halved. This milestone occurs every four years or after 210,000 Bitcoin blocks have been mined. The next halving is expected to happen in April 2024.

You can see an analogy between the current price movement of Bitcoin and the events of 2016-2017. A rise in prices four weeks before the halving, then consolidation and correction, after which a slow ascent begins, intensifying after six months.

In April, the TON Foundation plans to distribute 30 million Toncoin to active community members

The blockchain development team at The Open Network (TON) has sparked community interest by announcing a giveaway of 30 million Toncoin (worth over $125 million at the time of writing) for active user participation in the project's ecosystem.

Starting April 1 and throughout the month, the team will generously reward users for participation in four key areas:

- The League is a platform for competition among Web3 project developers, promising to stimulate innovation and creativity.

- Token mining is the creation of convenient mechanisms for obtaining native coins, which will intensify the activities of miners and expand the ecosystem.

- Quests and airdrops are a step-by-step introduction to TON projects and the distribution of tokens, facilitating training and attracting new users.

- Increasing the liquidity pool is a strategy aimed at expanding the financial base of the ecosystem and ensuring its stability and growth.

According to the developers, this program is designed to expand the TON user base and increase its involvement. Detailed information about each of the areas is available on the team blog.

Almost 50% of investors are considering Solana

In 2024, Solana confidently declared itself, attracting the attention of 49.3% of global investor interest in blockchain ecosystems. These impressive numbers are confirmed by CoinGecko analysts who analyze internet search data.

Experts attribute Solana's leading position to a number of factors, ranging from the soaring price of SOL since 2021 to the development of ecosystem projects such as Pyth, as well as the popularity of meme tokens like dogwifhat.

Ethereum is in second place in the ranking, with a share of interest of 12.7%. This is facilitated by brand recognition and reliability, according to CoinGecko analysts. However, there is a shift in investor attention towards secondary networks built on Ethereum, which does not go unnoticed by analysts.

In third place on the list was BNB Chain, created by Binance, with an interest share of 5.4%. The rise in the price of BNB played a role in attracting attention, experts confirm, noting similarities with the situation around SOL.

Vitalik Buterin spoke about the fight against the risks of centralization in the Ethereum betting ecosystem

During a conference in Taiwan, Vitalik Buterin, one of the co-founders of Ethereum, brought up an important issue related to the Proof of Stake (PoS) mechanism in the Ethereum network - the centralization caused by staking services. In his opinion, platforms such as Lido, Coinbase and Binance have gained an “unjustifiably large market share.”

The liquid staking locked on the platforms amounts to an impressive 9.8 million ETH, representing 30.5% of the total. And the Coinbase and Binance services control a combined 18% of this indicator.

Buterin drew attention to the so-called “lazy stakers” who own a minimum amount of ETH (32 ETH is the required threshold for staking), but prefer to use services instead of independently participating in ensuring the operation of the network.

He expressed support for the Rainbow Staking concept proposed by Barnabe Monnot of the Ethereum Foundation in February. This staking concept aims to encourage the participation of various categories of service providers, including both “single players” and “professionals”, in the network economy.

Ethereum developers seek to increase the gas limit

Developer Eric Conner and ex-head of smart contracts at MakerDAO Mariano Conti put forward a proposal to increase the gas limit on the Ethereum network from 30 million to 40 million. They launched a web platform called Pump The Gas to promote their initiative.

It is estimated that this change could result in a potential reduction in network fees of 15–33%. Conner and Conti encouraged solo stakers, client development teams, pools, and community members to join in supporting this proposal with concrete recommendations and steps to action. They explained that while EIP-4844 in Dencun significantly reduced fees in layer 2 solutions, it had no impact on the Ethereum mainnet. However, some Ethereum developers and supporters did not support this initiative.

The gas limit represents the maximum amount of computing resources that can be used to process transactions or execute smart contracts in a single block. It is currently capped at 30 million.

Vulnerability in Apple's M chip could cause private keys to leak

Experts have discovered a serious vulnerability in Apple's M series chips that allows attackers to extract private keys from Mac devices. This vulnerability remains unresolved due to the micro-architectural design of the silicon itself, making it impossible to completely eliminate it. The only thing that can be done is to mitigate its effects by implementing additional protection through third-party software. However, this will result in a significant reduction in device performance, especially on the early M1 and M2 models.

An attacker does not need physical access to the device to exploit this vulnerability. It allows you to remotely access a device using user rights instead of administrator rights, making it much easier to log in to carry out an attack.

Trezor X account hacked to promote crypto scams

The official account of X-company, manufacturer of Trezor crypto hardware wallets, was compromised, and attackers began distributing a series of fraudulent messages about supposed presales on Solana.

Noticing suspicious activity, an on-chain researcher known as ZachXBT raised the alarm about what was happening. Then the Scam Sniffer service also recorded suspicious activity.

In the fake posts, the attackers promoted fake pre-sales of the TRZR token for SOL and included links leading to malicious resources. Additionally, the posts used the popular meme coin SLERF, possibly to draw more attention to their fraudulent scheme.